"*REVISED FOR REPEAL OF EXCISE TAX EFFECTIVE DECEMBER 11, 1971."

Window stickers in 1972 production vehicles (GM, Ford, Chrysler and others), sometimes would or could have printed on them near the bottom of the window sticker a message to the effect of this vehicle not having any Federal Excise Tax (FET) included in the price, and yet others would not have this message. Which then begs the question, why?

Previously, the window, or sticker price on new cars included a federal excise tax, and the state's sales tax was based on that total amount. On December 11, 1971 a new law was passed repealing the FET tax retroactively effective back to August 15, 1971.

So now the manufacturers have a small dilemma on their hands. The law is passed on December 11th, what to do the next day December 12th? Their current stock of window stickers (at least GM's) in use has printed on it that a 7% FET tax is included in the price. Since GM doesn't have any new replacement window stickers to use on the 12th, the best solution is to print as part of the window sticker print job at the factory, is to state at the bottom that this vehicle now does not include any FET taxes according to the law so the consumer can see it. Then as we see, GM will start using a new and revised window sticker for the rest of 1972 production vehicles and will no longer have to print this repealed message at the bottom of the window sticker.

And there we have it. The next question would be how long did they they have to print this extra information on the window sticker until the new revised window sticker was available, 1 week? 2 weeks? the remaining month of December? Any overruns into January of 1972? Unfortunately, window stickers never have a date on them. Not even a date printed. About the only way determine when the switch was made is to see a lot of window stickers from December '71 for that specific plant. From those we could look for a serial number cut-off range. But, from that cut-off point you need the vehicle date of manufacture (DOM) to associate with the serial number (good luck!). The DOM is found on separate documentation which most people do not have.

Let's see an example.

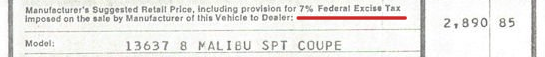

Here is a snippet from a 1972 GM Malibu window sticker. On the window sticker you can see printed on it the wording about the 7% FET tax. Then on this same window sticker [snipped & cropped] at the bottom is the notice to the consumer printed on the printer at the factory about it not including the tax in the price:

Same window sticker bottom section with updated information as the computer printed the window sticker:

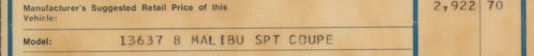

So that works fine until the new form redesign is available. And here is the new replacement window sticker to replace the old one for the rest of 1972 production. It has references to any FET tax removed from it and the factory no longer needs to print any notice at the bottom of the window sticker:

From this information, if you are trying to determine approximately the DOM time frame your vehicle may have been made and you have your window sticker, you can roughly date your vehicle based on what is or is not present on the window sticker.

If you have the 7% FET on the window sticker but no printed message on the bottom, the DOM is before December 12, 1971.

If you have the 7% FET on the window sticker and you have the message on the bottom, the DOM is December 1971.

If you have the new window sticker style with no 7% FET information on it, it is probably January 1972 or newer.

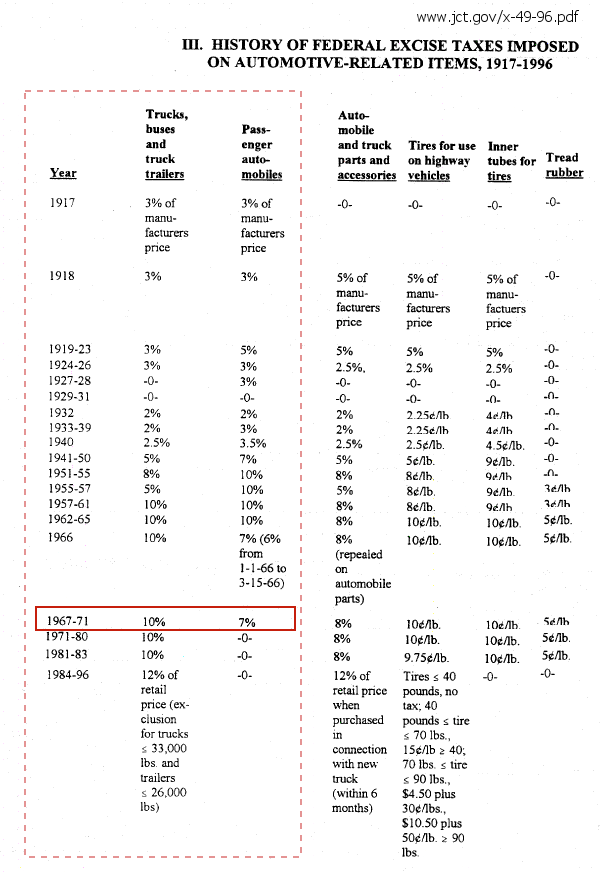

Here is a quick history of federal excise tax rates:

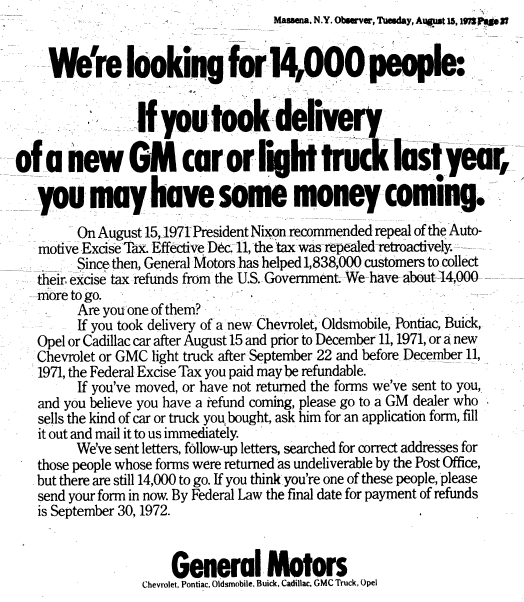

For those consumers who purchased a new vehicle between August 15, 1971 and December 11, 1971, they are entitled to a refund on the 7% FET tax and they are entitled to a state tax refund paid on the 7% FET tax.

Here is an ad placed in a paper by GM seeking missing refundees:

But wait! it's not over for the consumer. The consumer has a rebate coming on the state tax paid on the amount of the excise tax. This is roughly $10 or so. But for some states it was not so easy to get your refund as the tax has already been paid and the states didn't know how handle this (apparently). Here is a link to an article from the Chicago Tribune, Friday March 22, 1974 reporting that refunds from 1971 on FET taxes are coming "soon"! Car Tax Refund Months Away

Why the FET Tax Was Repealed

Congress repealed the excise tax on passenger automobiles to provide a stimulus for the purchase of cars and because of the jobs it would create. In addition Congress has previously concluded that excise taxes on automobiles are undesirable because the interfere with the freedom of the consumer choice. The tax on light-duty trucks was repealed because they are used by many family farms as a means of personal transportation comparable to that of passenger cars.

References and Further Reading:

[PDF] H.R. 10947: The Revenue Act of 1971 - Senate Finance Committee Page 8, Excise Tax on Automobiles, Trucks, Etc.[link] General Explanation of the Revenue Act of 1971 Page 77, Section D. Repeal of the Manufacturers Excise Tax on Passenger Automobiles, Light-Duty Trucks Etc.

[PDF] General Motors Newspaper ad We're looking for 14,000 People, The Massena Observer, August 15, 1972 Page 27

[PDF] Selected Background Information and Data on Federal Transportation Excise Taxes Page 10, FET tax history chart.

Leave a Comment